Our Approach

Cube Holdings delivers a national-level cryptocurrency asset recovery framework that enables authorities to:

- Detect and assess illicit digital asset activity

- Support lawful seizure and custody of crypto assets

- Securely liquidate and realise recovered value

- Maintain full sovereign oversight and control

The framework is modular, jurisdiction-agnostic, and aligned with international regulatory and legal standards.

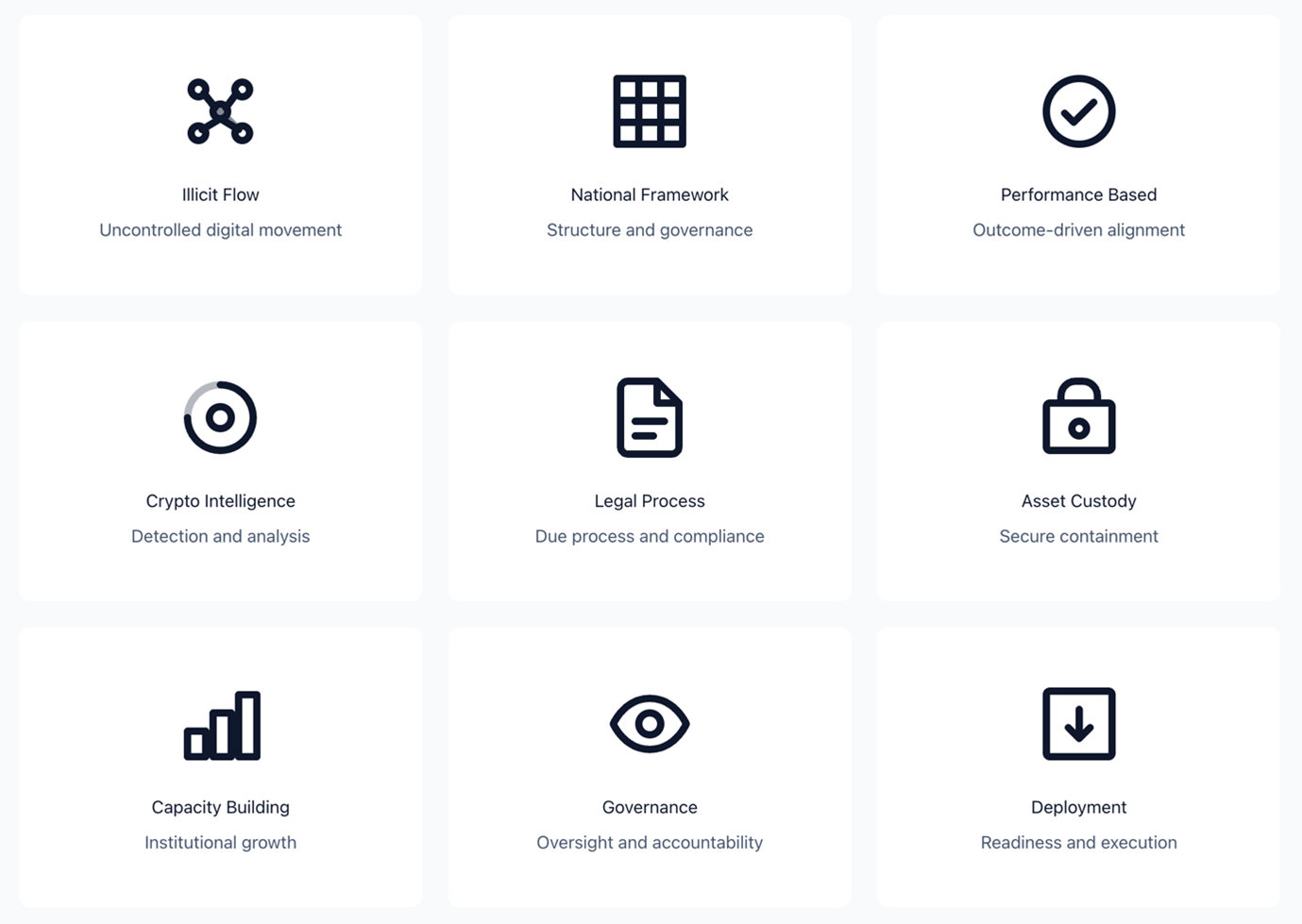

Core Capabilities

(Icon-led, minimal copy)

- Cryptocurrency Intelligence & Monitoring

Advanced blockchain analysis and transaction tracing

- Legal & Regulatory Support

Alignment with domestic and international seizure processes

- Asset Seizure, Custody & Realisation

Secure handling and conversion of recovered digital assets

- Institutional Capacity Building

Strengthening long-term government capability

Proven Experience & Partnerships

Cube Holdings works alongside established international partners with more than 15 years of specialised experience in financial crime, digital asset investigations, and complex asset recovery.

Together, these teams have supported successful government-led programmes and investigations across:

- The Americas

- Africa

- Europe

- Asia

- Middle East

This experience informs a mature, execution-ready approach suitable for sovereign institutions.

Governance & Integrity

- Designed for government and central bank environments

- Transparent, auditable processes

- Alignment with AML/CFT and international best practices

- No public disclosure of sensitive operations

Engagement

This service is intended for:

- Central banks

- Financial intelligence units

- Law-enforcement and regulatory authorities

Engagements are conducted through confidential, government-to-government style processes.